102-9 | 102-15 | 103-2 | 103-3

Votorantim: a permanently capitalized investment holding company, with a long-term investment approach, that seeks to deliver superior financial returns with positive social and environmental impacts.

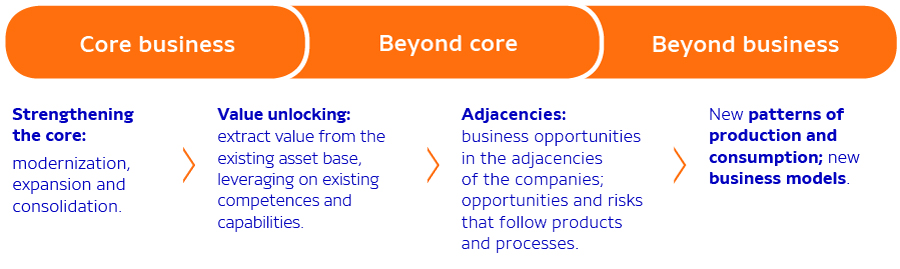

Achieving the investment objectives of its shareholders, acting in accordance with the management approach established in its DNA and complying with the financial and dividend policies are the essence of Votorantim’s management mandate. The investment approach encopasses major themes that apply both to existing businesses and to new opportunities: (i) strengthening the core business through investments in modernization, expansion and consolidation; (ii) extracting greater value from the asset base and leveraging existing skills and abilities; (iii) operating in business adjacencies, assessing additional opportunities and risks associated with products and processes; and (iv) paying close attention to new production and consumption patterns, as well as new business models that can present new opportunities and mitigate risks.

As a permanently capitalized investment holding company, with a long-term investment approach, Votorantim seeks to deliver superior financial returns with positive social and environmental impacts. From a financial standpoint, its business portfolio is exposed to the typical seasonal cycles of different industries in different locations around the world. To reduce exposure to risks, the company seeks to add to its asset profile new businesses with secular demand and potential for value creation – such as energy and real estate, which are already part of the portfolio. Aligned with this approach, in 2020, Votorantim advanced its investment strategy through the approval of R$ 2 billion to be invested in the development of new wind farms in the northeastern region of Brazil by the joint venture between Votorantim Energia and CPP Investments (learn more).

Also in line with the search for opportunities to drive new businesses, Real Estate Investments evolved from an internal area into the company Altre, Votorantim’s real estate investment platform.

In parallel, the company expects to increase its investments in developed markets, which may occur directly or via portfolio companies. An example of progress in this area was the announcement of the combination of cement assets in North America with McInnis Cement, which will result in a partnership between Votorantim Cimentos and Caisse de dépôt et placement du Québec (CDPQ), with a focus on expanding operations in the Great Lakes region, eastern Canada and the northeast coast of the United States (learn more). Also in the context of this strategy, during the year Votorantim increased its exposure to developed markets through investments in highly-liquid securities.

The investment approach is driven by a key principle: our capital is patient, our business purpose is non-negotiable. This means carefully analyzing opportunities to make investment decisions in line with Votorantim’s values and DNA, as well as the guidelines discussed with shareholders. This behavior is one of the fundamental drivers of the construction of Votorantim’s portfolio and its business conduct, and it is also reflected in the influence it exerts over the portfolio companies to adopt best practices in the environmental, social and corporate governance areas.

Patient capital, non-negotiable purpose

102-12 | 102-18 | 102-26 | 102-27 | 102-29 | 102-32

Votorantim adopted ESG (Environmental, Social and Governance) standards even before the term was created. In 2020, Memória Votorantim, a content hub that connects the company’s past and present, conducted a survey to review the history of Votorantim and its portfolio companies in the environmental, social and governance spheres. This project identified, for example, that the first publication of Votorantim’s Annual Report dates back to 1923; since then, the company has maintained its commitment to transparency, evolving the level of information disclosed and adapting to the best market practices, such as assurance or use of a global methodology for standardizing ESG indicators. The year 2020 marks the tenth publication of the Annual Report in accordance with the standards of the Global Reporting Initiative (GRI).

During the year, Votorantim also advanced its initiatives on ESG from the perspective of the investment holding company, developing a structured plan that includes a renewed approach that was discussed both by its Board of Directors and within the portfolio companies.

According to corporate governance principles, each of the portfolio companies has autonomy to manage ESG issues, in line with its business strategies. In this context, Votorantim has three key ESG-related objectives:

Based on the ESG plan, the holding company intensified its participation in the UN Global Compact, an initiative that promotes fundamental and internationally accepted values in the areas of human rights, labor relations, the environment and the fight against corruption, to which Votorantim has been a signatory since 2011. This voluntary commitment extends to the portfolio companies. In 2020, banco BV and Votorantim Energia also became direct signatories, joining Votorantim Cimentos, Nexa and CBA.

During the year, Votorantim also became a member of CDP, the largest environmental database in the world. The purpose of joining the organization was to develop a pilot project with Votorantim Cimentos and CBA for the analysis of their environmental information and how to integrate it to the investment analysis process in a structured manner.

With regard to reporting on ESG issues, one advance is the inclusion, starting with this annual report, of Votorantim’s main contributions to the Sustainable Development Goals (SDGs). A United Nations (UN) initiative launched in 2015, the 17 SDGs are divided into 169 goals and 248 indicators that combine the three dimensions of sustainable development: economic, social and environmental.

To this end, Votorantim developed a methodology to identify and prioritize these contributions, in order to determine which of them met basic criteria to be considered for this publication. In addition, the company conducted a market study, including an assessment of the reporting practices of the portfolio companies, to determine how these contributions would be disclosed.

The methodology included extensive work to verify each target, to identify, according to Votorantim’s materiality, which of them:

In the first phase, the goals were scored against the achievement of each of these criteria through the classification method explained above. After the first stage, a qualitative review was performed to test the results and indicate potential adjustments between the practices and targets that received the highest score. The inclusion of SDG 5 (Gender Equality) occured at this phase. Despite not being included in the current materiality matrix, gender equality is an issue of increasing importance within Votorantim, supported by structured initiatives, employee engagement and discussions with the portfolio companies through the governance chain.

The result of this process was the prioritization of 13 SDGs, including a total of 37 goals, which are detailed in the infographic that illustrates the holding company’s view of its contributions to each SDG.

102-15 | 102-21 | 102-46

Published in 2018, Votorantim’s materiality matrix identifies the most relevant topics to be reported, according to the interests of its stakeholders. The process to determine its content included three stages:

(i) Analysis of internal documents of Votorantim and the portfolio companies;

(ii) Interviews with company executives, sustainability and corporate governance employees of the portfolio companies, specialists in finance and sustainability, academics and local and international investors; and

(iii) Integration of data and information collected in the two previous stages. 102-40 | 102-42 | 102-43

Given the diversity of Votorantim’s portfolio, the topics identified through this process were categorized into two dimensions:

Participants of the Global Compact

Respondents to CDP’s public climate questionnaire in 2020

Publication of annual reports

Green financing

• Votorantim Cimentos (revolving credit facility)

• Banco BV (green bonds)

• CBA (export credit notes)

Specific topics of the portfolio companies

102-47

102-47

Created in 2003 as part of the celebrations of Votorantim’s 85th anniversary, the purpose of Memória Votorantim is to map and preserve documents on the company’s history. In its almost 20 years of operation, the role of Memória has evolved and the area is currently responsible for the historical record and production of content based on Votorantim’s past and present, the portfolio companies, their entrepreneurs and employees. Its historical collection and capacity to analyze and manage knowledge are divided into three main axes:

These axes complement each other and enable the development of projects, products and in-depth research on the company’s trajectory.

Since Votorantim’s history is intrinsically linked to the history of Brazilian industrialization, Memória is open to the public by appointment, both for visits to the exhibition it maintains in its office located in Vila Leopoldina, in São Paulo state, and for research.

World Benchmarking Alliance

Votorantim was named one of the 2,000 most influential companies in the world for its best practices in a ranking promoted by the World Benchmarking Alliance (WBA), an organization leading the movement to expand the impact of the private sector toward a sustainable future. The holding company was mentioned, through Votorantim Cimentos and Citrosuco, in four strategic transformations that are related to the UN Sustainable Development Goals (SDGs):