103-1 | 103-22 | 103-3

102-18 | 102-19 | 102-20 | 102-24 | 102-26 | 102-27 | 102-29 | 102-31

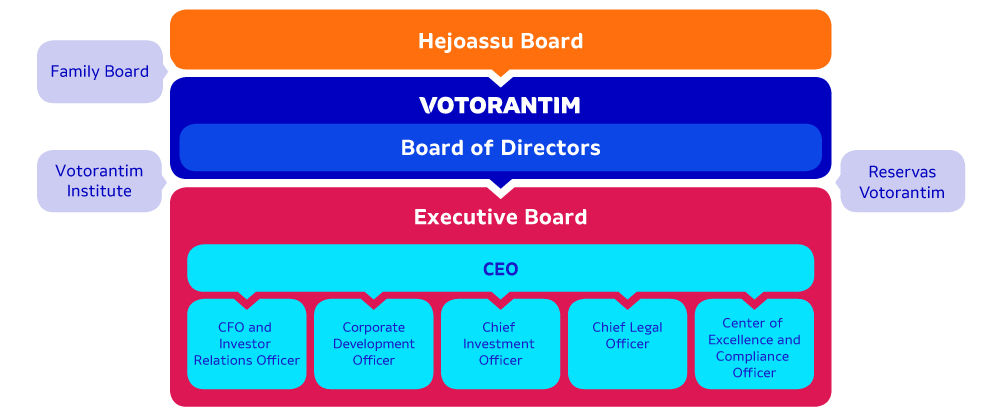

Votorantim’s governance is anchored on three complementary axes:

CPP Investments

102-17

The Canadian fund authored an article on family businesses in which it recognized Votorantim for its strength, appetite for smart risk-taking and sound corporate governance. The article highlighted the company’s long-term perspective, considering the fact that it has existed for six generations and has plans for many more to come.

Access the article

Votorantim is constantly improving and evolving its corporate governance practices. Although not all portfolio companies are listed, since 2014 each company has also adopted its own robust governance model that includes its own Board of Directors, advisory committees and Executive Boards, which are responsible for deliberating on strategies, management and investments.

The members of the Boards of Directors of Votorantim and of Hejoassu and of the Family Board serve three-year terms. The last two bodies operate independently from Votorantim, and integration between them is ensured by a formal schedule of meetings. In the portfolio companies, the Boards of Directors are composed of shareholders, employees of the holding company and external independent members. Votorantim also performs periodic assessments of boards and committees, which ontribute to the evolution of its governance.

It is composed of 12 shareholders, with three representatives from each of the four family holding companies. It works independently and is responsible for recommending to Votorantim its financial aspiration, macro vision and risk appetite, and for appointing members of the Board of Directors of Votorantim. The Board is also the guardian of Votorantim’s culture and DNA, ensuring the preservation of the family’s vision. In its sixth generation, the family is made up of 164 people, of whom 41 are shareholders.

Its current composition includes seven members, five from the fifth generation and two from the fourth generation, whose purpose is to promote family unity and the development of family members, and to act as a link in the communication between the family and businesses.

To this end, it develops initiatives supported by a model that considers the categories of Shareholders, the Family, Careers and Social Engagement. In 2020, the focus was on Social Engagement, which, due to the pandemic, expanded its reach by pursuing the best strategies, which included the Hejoassu Board and alignment with the holding company and the Votorantim Institute in the fight against COVID-19, leveraging the activities with synergy. One of the joint activities with the Votorantim Institute was raising funds—part of which was donated by banco BV—that were converted into food vouchers that were distributed to the Vila Leopoldina and Heliópolis communities in São Paulo. Approximately 100 family members from four generations were directly involved in the initiative.

In 2020, the Board’s structure was also strengthened through the work of its Social Committee, which deals with issues relating to entities historically supported by the family: Associação de Assistência à Criança Deficiente (AACD), BP – A Beneficência Portuguesa de São Paulo and A.C. Camargo Cancer Center. The Committee raised funds that supported telemedicine projects at the three institutions, in addition to enabling other initiatives, such as Telethon, a TV marathon to raise awareness and mobilize public support for people with physical disabilities.

The challenge of social distancing was faced with creativity and innovation. Plant tours, which include family members of the fifth and sixth generations between 10 and 12 years of age, were held virtually. Throughout the year, other initiatives were also adapted to meet the social distancing requirement and took place in the form of live virtual events and podcasts, with invited specialists presenting content that was relevant for that moment.

Integrity

Being ethical and acting with integrity, honoring our history and creating the future with respect

Generosity

Being generous with yourself, the family and society

Courage

Persevering, always being open to learn and evolve, and believing that everything is possible

Unity

Honoring the history that unites us, valuing our collective Power and owning the creation of our Legacy

Impact

Working with dedication and achievement-focused energy, driven by the power to innovate and transform

Passion

Having freedom and motivation to find and pursue your passions

In 2020, the Board of Directors was strengthened with the arrival of Marcos Lutz and maintained its composition of seven members—one chairman, one deputy chairman, two board members and three independent board members. The chairman and independent board members are not part of the shareholder family. The responsibilities of the Board of Directors include preparing the strategic plan and determining the actions needed to put it into practice, deliberating on capital allocation, appointing the members of the Executive Board and the Boards of Directors of the portfolio companies and monitoring their performance.

Members102-22 | 102-23

| Member | Position |

|---|---|

| Eduardo Vassimon | Chairman |

| José Roberto Ermírio de Moraes | Deputy Chairman |

| Cláudio Ermírio de Moraes | Board Member |

| Luís Ermírio de Moraes | Board Member |

| Marcelo Medeiros | Independent Board Member |

| Marcos Lutz | Independent Board Member |

| Oscar Bernardes | Independent Board Member |

This includes the CEO and five officers, whose responsibility is to conduct the company’s operations in accordance with the strategic guidelines outlined by the Board of Directors.

Members102-22 | 102-23

| Member | Position |

|---|---|

| João H. Schmidt | CEO |

| Glaisy Domingues | Chief Legal Officer |

| Luiz Caruso | Center of Excellence and Compliance Officer |

| Marcio Yamachira | Corporate Development Officer |

| Mateus Gomes Ferreira | Chief Investment Officer |

| Sergio Malacrida | CFO and Investor Relations Officer |

102-17 | 102-25

Ethics Line – 0800 89 11 729

In 2020, the Compliance area participated in the effort to fight the pandemic. A working group was created to direct the donations approved by the COVID-19 Committee, which was made up of representatives of Votorantim, the portfolio companies, the Votorantim Institute, BP – A Beneficência Portuguesa de São Paulo, and the shareholder family. The responsibilities of this committee included evaluating and deliberating on the donation strategy and ensuring smooth processes and the proper allocation of resources, in addition to preventing the expectation of reciprocity from the benefited municipalities.

Together with the Votorantim Institute and BP – A Beneficência Portuguesa de São Paulo, more than 170 due diligence processes were carried out to identify, through a series of indicators, the level of integrity of the municipalities considered for donations; internal documents were also created to formalize the processes and provide accountability. One of the measures adopted was the staggering of donations in a way that future installments were only released once the previous installment had been accounted for. Another differentiated approach had to do with the delivery of the donations, which was made by the company itself, leveraging Votorantim Cimentos’ extensive logistics network.

At the same time, steps were taken during the year to improve the compliance and risk structure, guided by the concept of Compliance 4.0. One example is the Government Interaction Records (Registros de Interação com Agentes Governamentais, RIGs), a system that was migrated to an external platform managed by specialists. It concentrates al information in this area, including Compliance Declarations and training on the Code of Conduct, as well as the analysis of risk maturity and compliance of Votorantim Cimentos, Votorantim Energia, Nexa, Citrosuco and CBA.

Focused on the organization and optimization of processes, the Legal Suppliers Management (LSM) project advanced during the year. Its goal is to standardize, streamline and decentralize the contracts made within the scope of the Legal department. Part of this process was transferred to the Center of Excellence (CoE) and another part involved the review of contracts and minutes, and adjustments to the payment and registration flows.

As a result of the pandemic, the third Compliance Week was held virtually, which did not compromise the discussions on issues involving ethics and integrity in internal and external relations. Executives from Votorantim and the portfolio companies and the Chairman of the Board of Directors, Eduardo Vassimon, participated in the panels. Also a discussion on donations and relationships with public officials were held by political scientist Humberto Dantas, Adjarbas Guerra (director of Governance, Risks and Compliance of Votorantim Cimentos) and Cloves de Carvalho (director of the Votorantim Institute). 205-2

Compliance resources 102-17

102-9 | 102-10 | 102-11 | 102-30

Votorantim quantifies its risk appetite annually, considering its role as an investment holding company. The portfolio companies, in turn, are responsible for identifying, measuring and addressing strategic, reputational, social, environmental, regulatory and financial risks, and determining their risk appetite by taking into account risk probability and impact.

The assessment of risk appetite considers qualitative aspects—that is, the definition of risk categories and willingness to incur a certain risk in relation to the predicted return or impact—and quantitative aspects—considering the maximum risk that Votorantim is willing to take within the scope of its global capacity. This assessment results in a classification of tolerance levels, which trigger the appropriate governance tiers.

The pandemic prompted the mapping of a series of risks encountered in previous global crises, which were added to those already identified and applicable to the current context, such as compromise of reputation and misappropriation of funds and material, as well as misuse of resources by the government. The holding company exercised care when dealing with all assistance programs, using its probability and impact assessment to guide mitigation initiatives.

Through participation in the governance bodies of the portfolio companies, Votorantim influences and monitors the appropriateness of their risk appetite level, considering variables such as the markets where they operate, positioning and expectations.